There is a quick recruitment opening for a Loan Officer in Mumbai, Maharashtra, suitable for candidates who have experience or interest in loan processing, customer interaction, and basic financial documentation. This vacancy has been listed by a verified employer on the National Career Service (NCS) portal, making it a genuine and dependable opportunity for candidates looking for immediate hiring in the finance and lending sector.

I’m sharing this opening because Loan Officer roles continue to be in steady demand, especially in cities like Mumbai, where banks, NBFCs, and finance companies handle a high volume of personal, business, and consumer loans every day. Many candidates with sales, finance, or customer service backgrounds look for roles that offer both stability and performance-based growth. However, quick recruitment openings are often missed due to lack of clear information or uncertainty about job authenticity. Since this vacancy is officially available on the NCS portal and does not involve any consultancy fees or agents, it becomes important to highlight it clearly so eligible candidates can apply directly and without hesitation.

About the Role

The Loan Officer will be responsible for assisting customers with loan enquiries, collecting required documents, and supporting the loan application and verification process as per company guidelines.

Key Details

| Particulars | Information |

|---|---|

| Job Title | Loan Officer |

| Location | Mumbai, Maharashtra |

| Employer Type | Private Organisation (Verified on NCS) |

| Job Type | Full-Time |

| Mode of Application | Online |

| Experience Required | Freshers and experienced candidates can apply |

Roles and Responsibilities

The main responsibilities of a Loan Officer include:

- Explaining loan products and eligibility criteria to customers

- Collecting and verifying customer documents

- Assisting in loan application processing

- Coordinating with verification and credit teams

- Following up with customers for pending information

- Maintaining accurate loan and customer records

- Supporting disbursement and post-loan processes

Skills Required

Candidates applying for this role should have:

- Basic understanding of loan or financial products

- Good communication and customer handling skills

- Ability to explain processes clearly to customers

- Basic computer knowledge for data entry and tracking

- Attention to detail while handling documents

- Willingness to work with targets or timelines

Eligibility Criteria

- Educational Qualification: Graduate or equivalent qualification preferred

- Experience: Prior experience in banking, NBFC, or loan sales is an advantage but not mandatory

- Age Limit: As per company norms

- Work Readiness: Comfortable with field or office-based loan-related work

Applicants should check the official job listing on the NCS portal for exact eligibility requirements.

Salary and Benefits

The salary for Loan Officer roles in Maharashtra depends on experience, performance, and company policy. Candidates can generally expect:

- Fixed monthly salary

- Performance-based incentives or commissions

- Training support for new joiners

- Exposure to banking and financial services operations

- Opportunity for long-term career growth

Exact salary details are usually discussed during the interview process.

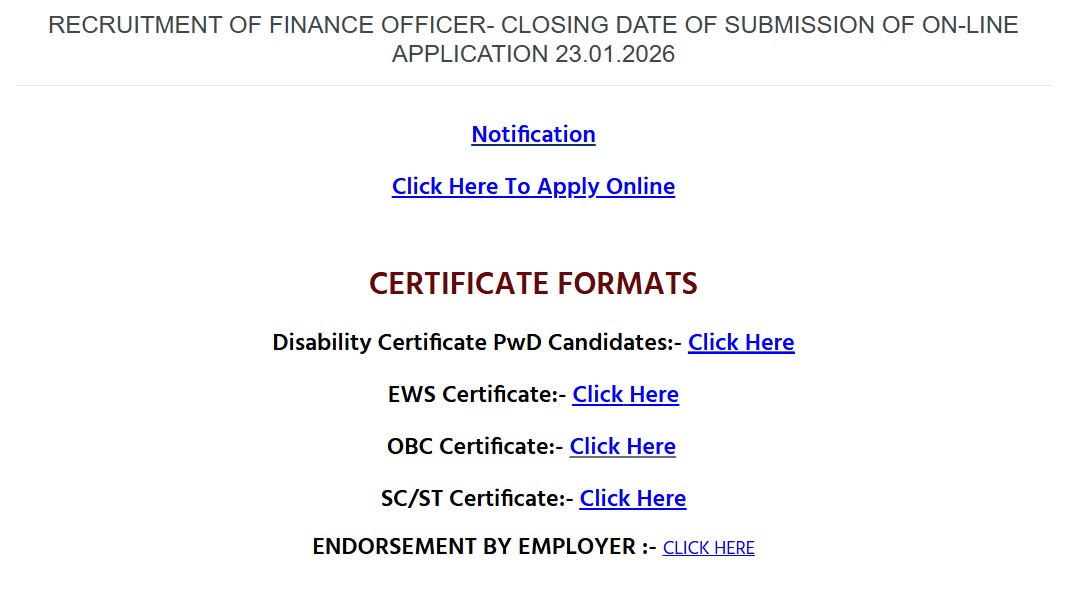

How to Apply

Interested candidates can apply online through the official National Career Service website by following these steps:

- Visit the official NCS portal: https://www.ncs.gov.in

- Log in using your Job Seeker ID and password

- New users can register for free on the same website

- Search for “Loan Officer – Maharashtra, Mumbai”

- Open the job listing and read all details carefully

- Click on Apply and submit the application

- Save the Job ID for future reference

Candidates are advised to apply as early as possible, as quick recruitment roles are often closed once positions are filled.