The CUET PG 2026 registration process is expected to begin soon, opening the door for postgraduate aspirants aiming for central and participating universities across India. Conducted by the National Testing Agency, the Common University Entrance Test for Postgraduate programmes has become the main gateway for MA, MSc, MCom and other PG admissions. The application process will be completely online, and candidates will need to submit the form within the announced schedule to be considered for admission.

I am writing about CUET PG 2026 registration because this exam has changed how postgraduate admissions work in India. Earlier, students had to fill multiple forms, track different entrance tests, and travel to several cities. CUET PG has brought everything under one common platform. From my interaction with students over the last two years, many still miss deadlines or make avoidable mistakes while filling the form. Knowing the application steps, fees, and eligibility in advance helps reduce stress and last-minute panic. For final-year students and working professionals planning higher studies, early clarity also helps in subject selection and preparation strategy.

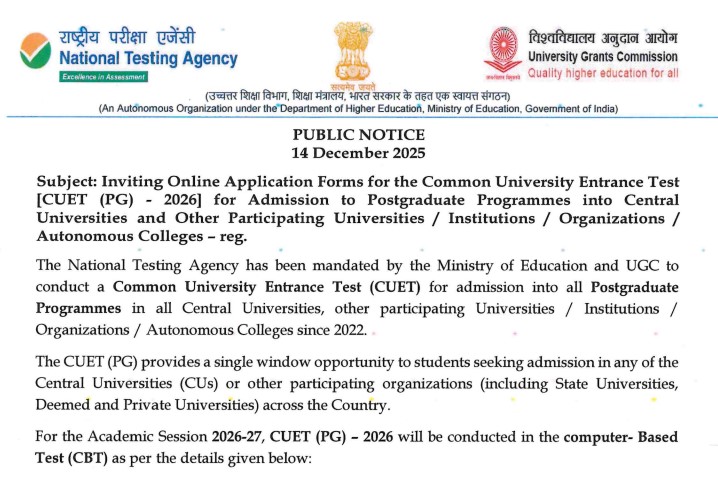

What Is CUET PG 2026

CUET PG 2026 is a national-level entrance exam conducted by NTA for admission to postgraduate courses offered by central universities and other participating institutions. The exam tests subject knowledge and analytical ability relevant to the chosen course.

Scores obtained in CUET PG are used by universities to prepare merit lists and conduct counselling.

CUET PG 2026 Important Dates & Links

The official dates will be announced by NTA through a detailed notification. Based on previous trends, the timeline usually follows this pattern:

- Online registration starts: 14/12/2025

- Last date to apply: 14/01/2026

- Notification: Click Here

- Online Apply: Below This Post

- Official Website: Click Here

- Application correction window: 18/01/2026 to 20/01/2026

- Admit card release: A few days before the exam

- Examination period: Mid to late 2026

Candidates should regularly check official updates to avoid missing deadlines.

CUET PG 2026 Application Form Details

The CUET PG application form will be available online only. Candidates will need to register using a valid email ID and mobile number, fill personal and academic details, select subjects and exam cities, and upload required documents.

Accuracy is important, as incorrect details can create problems during counselling.

CUET PG 2026 Application Fees

The application fee varies based on category and number of test papers selected. While exact figures for 2026 will be confirmed in the notification, the fee structure generally follows this pattern:

- General category candidates pay a higher fee

- Reserved category candidates get a reduced fee

- Additional fee applies if more test papers are selected

Fees must be paid online through the available payment modes.

Eligibility Criteria for CUET PG 2026

To apply for CUET PG 2026, candidates must meet the basic eligibility conditions:

- A bachelor’s degree in the relevant discipline from a recognised university

- Final-year students can also apply, subject to meeting eligibility at the time of admission

- Specific universities may set minimum marks or subject requirements

Candidates should also check individual university admission rules, as eligibility may vary.

How to Apply for CUET PG 2026

Candidates can apply online by following these steps:

- Visit the official CUET PG website

- Complete the registration process

- Fill in personal, academic, and course details

- Upload photograph and signature in the prescribed format

- Pay the application fee online

- Submit the form and download the confirmation page

Direct Apply: Click Here

Keeping a copy of the submitted form is advisable for future reference.