A Historic Shift Written in Numbers

A remarkable turning point has emerged in South Asia’s economic narrative. Maharashtra, India’s financial powerhouse, has grown into an economy larger than that of Pakistan—an entire nation. What once appeared unlikely has now become a data-backed reality, highlighting how a strong regional economy can rival a country.

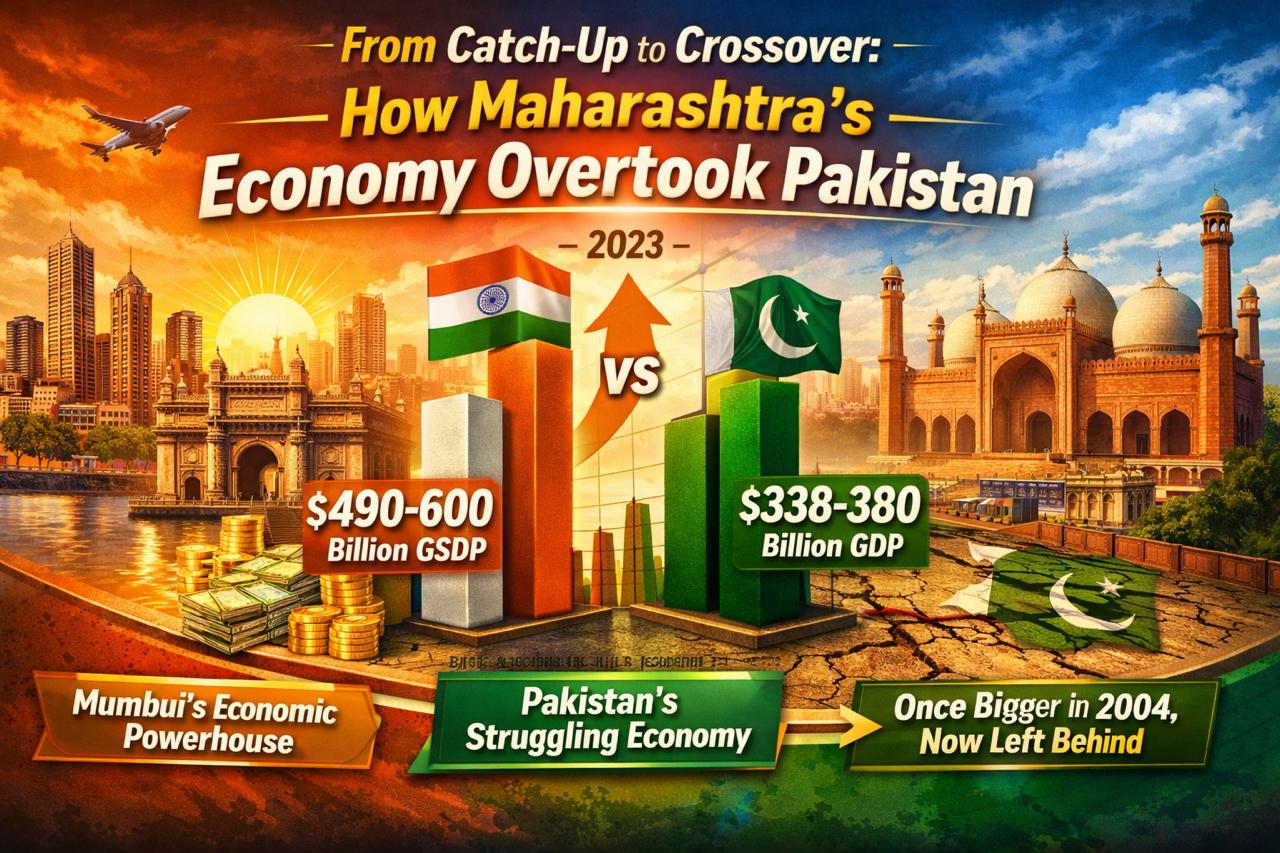

Numbers That Tell the Story

Recent estimates place Maharashtra’s Gross State Domestic Product (GSDP) between $490 and $600 billion. In 2023–24, the state recorded a GSDP of around ₹42.67 lakh crore. In contrast, Pakistan’s national GDP is estimated at $338–380 billion.

The historical comparison is even more striking. In 2004–05, Pakistan’s economy was about 1.5 times larger than Maharashtra’s. Two decades later, the balance has completely reversed.

The Power of Mumbai and Economic Scale

At the center of Maharashtra’s rise stands Mumbai, India’s financial capital. The city hosts banks, stock exchanges, multinational corporations, startups, and some of the country’s wealthiest individuals, creating a powerful engine for investment and innovation. A strong manufacturing base, a long-standing textile industry, a booming services sector, and stable agricultural output together make Maharashtra one of India’s most diversified economies.

Today, the state contributes nearly 14% of India’s total GDP, setting benchmarks in infrastructure development, tax revenues, and industrial growth.

Diverging Economic Paths

While Maharashtra accelerated, Pakistan struggled with persistent challenges such as debt pressure, IMF bailouts, currency instability, and slower core growth. These constraints limited expansion at a time when Indian states were increasingly competing on a global scale.

The contrast becomes even clearer when viewed regionally: Tamil Nadu, another Indian state, is already nearing $329 billion in GSDP, close to Pakistan’s entire economy.

More Than a Comparison

This milestone is not just about numbers or comparisons. It signals a broader shift in how economic power is distributed in the modern world. With the right mix of policy, infrastructure, and talent, sub-national regions can emerge as global economic giants.

Maharashtra’s journey proves that economic momentum—not just national borders—defines success. And right now, that momentum firmly belongs to the state.