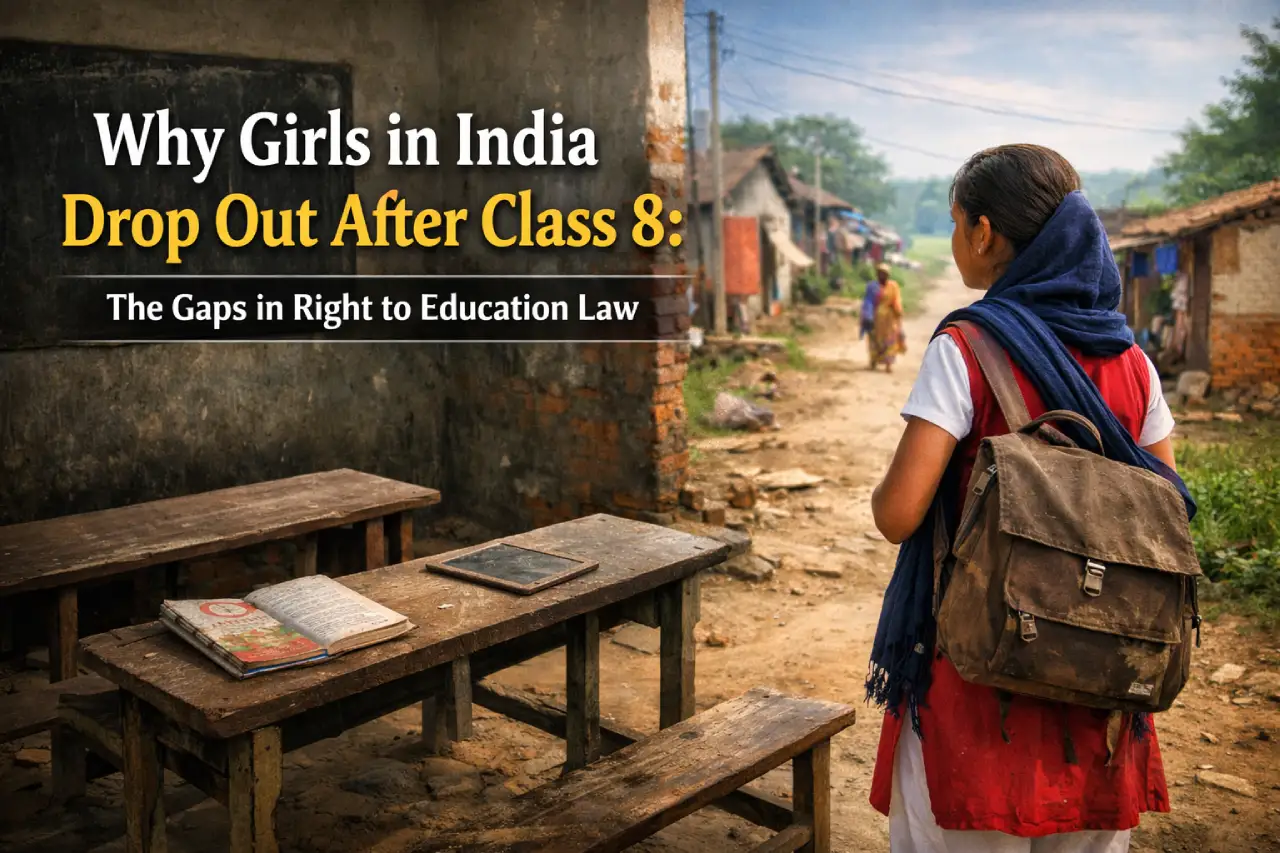

India’s Right to Education (RTE) Act guarantees free and compulsory education for children between the ages of six and 14. On paper, it looks like a strong promise. In reality, for millions of girls across the country, this right quietly ends just when education starts to matter the most. Once girls complete elementary school, many find themselves pushed out of classrooms due to social pressure, lack of nearby secondary schools, safety concerns, or household responsibilities.

I am writing about this issue because conversations around girls’ education often stop at enrolment numbers, not outcomes. We celebrate when girls enter school, but rarely ask whether they stay long enough to build real choices for their future. The truth is, the RTE Act’s age limit does not reflect the lived reality of girls in India. For them, education does not end at 14 because learning is complete, but because support systems fall away. If we are serious about gender equality, we need to look closely at where policy stops and where girls are left to manage on their own.

What the Right to Education Act Promises

The RTE Act, implemented in 2010, ensures:

- Free and compulsory education for children aged 6 to 14

- Neighbourhood schools at the elementary level

- No detention and no discrimination in early schooling

- Minimum infrastructure and teacher standards

This framework helped bring millions of children, especially girls, into primary schools. Enrolment gaps between boys and girls narrowed significantly at the elementary level.

Where the Problem Begins for Girls

The challenge starts once girls cross the age of 14. Secondary education falls outside the RTE’s legal protection. At this stage, several barriers appear together.

Many villages do not have secondary schools nearby. Parents are often unwilling to send adolescent girls to distant schools due to safety concerns or lack of transport. In poorer households, girls are expected to help with domestic work, sibling care, or family livelihoods. Early marriage, even when illegal, continues to pull girls out of classrooms quietly.

Data Shows a Sharp Drop After Elementary School

Government and independent studies consistently show that while enrolment is high at the primary level, dropout rates increase sharply after Class 8.

Key reasons include:

- Lack of affordable secondary schools

- Poor sanitation facilities, especially toilets for girls

- Safety concerns during travel

- Financial stress at home

- Social norms that prioritise boys’ education

By the time girls reach higher secondary level, many are already out of the system.

Why Age-Based Limits Hurt Girls More

Boys also face dropout risks, but girls are affected more because education for them is often seen as optional beyond a point. When the law stops protecting education at 14, families interpret it as a signal that schooling is no longer essential.

For girls, this gap becomes permanent. Once they leave school, re-entry is rare. Education delays marriage, improves health outcomes, and increases income potential, but these benefits are lost when schooling ends early.

The Gap Between Policy and Reality

India has schemes like scholarships, bicycles, uniforms, and hostel facilities for girls, but these are support measures, not legal guarantees. Without a strong right backing secondary education, these schemes depend on awareness, local implementation, and family consent.

What is missing is a clear policy message that education up to at least Class 12 is not optional, especially for girls.

What Needs to Change

If the aim is real equality, the solution must go beyond slogans.

Some critical steps include:

- Extending the Right to Education to cover secondary education

- Investing in safe, nearby secondary schools

- Ensuring transport and hostel facilities for girls

- Making schools more welcoming for adolescent girls

- Engaging families and communities consistently

Education policies must reflect how long learning actually takes to change a life.

Why This Conversation Matters Now

India talks about becoming a developed nation, but that goal is difficult to imagine when girls are pushed out of school at the age when they should be building skills and confidence. Education is not just about literacy; it is about agency.

When the right to education ends early, it is not the law that suffers, but girls who lose opportunities quietly, one by one.